(c) 2022 Invest-Aware.com All rights reserved. (800) 457-1958

For advertising purposes only. Proceed at your own risk.

For advertising purposes only. Proceed at your own risk.

It's all in the presentation. The First In Marketing Team produces Offering Memorandums, Feasibility Studies, Case Studies, and Property Profiles for lenders and investor partners. Ask about copy for campaigns, blog, social media, and website. Hourly and project rates are.......

Show what your deals will look like before, during, and after with state of the art renderings and rendering videos. For larger projects, you can present investors, lenders, contractors, and potential buyers and tenants with Interactive......

Custom Marketing & Market Research

Custom Interactive Virtual Staging

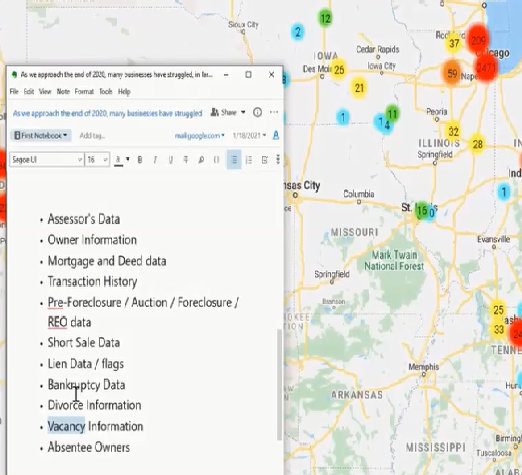

Investors seeking Single Family home deals locally or the best deal from around the country can access and compare on market and off market listings on a daily basis. You can work with whichever agent or broker you choose. Look in to as many potential deals as you like with unlimited national access. Search by location, price, and other investor criteria.......

Finding Available Invest Properties Locally and Beyond

Need help putting your next deal together?

We produce custom Case Studies, Feasibility Studies, Market Research, and Property Profiles!

Let us help with branding. We produce Online Courses, Webinars, Sales/Operations Manuals, and much more!

We produce custom Case Studies, Feasibility Studies, Market Research, and Property Profiles!

Let us help with branding. We produce Online Courses, Webinars, Sales/Operations Manuals, and much more!